Naya Pakistan Housing: The lies we tell

There are lies we tell others, and then there are those lies that we tell ourselves hoping if we bury our heads in the sand long enough, they will become irrelevant. That the Naya Pakistan Housing Program (NPHP) will provide housing to poor and low-income households may be one of the most blatant lies this government might be telling itself. At best, it is a housing scheme that will boost supply which could spur demand in the long term. At worst, it is a housing scheme that will boost supply with no demand insight.

But to properly evaluate NPHP, readers must walk back to the time when Imran Khan first announced this ambitious plan to construct 5 million houses across a five year period. Where did this 5 million number come from? In fact, let's walk back a little further in time. Over the past several years, every time the housing shortage is mentioned in Pakistan, the estimated number quoted is 10 million. The State Bank of Pakistan (SBP) associates this number to the World Bank whereas the World Bank credits this number to the SBP, coming back full circle—the rest of the myriad of stakeholders who mention this number being none the wiser. So a mammoth 10 million housing shortage, source unknown.

In essence, when PM Imran Khan arbitrarily picked the 5-million target for the supply of housing under the NPHP plan, there seems to be no background research backing this agenda. That is not new—political party agendas are seldom backed by sound research but when such an agenda becomes a policy, surely that's when it must.

To introduce any housing plan, the most basic question that must be asked is: what is the demand and where (in terms of geographic and socioeconomic standing) is the demand. Had that research been done, the policy would have been designed accordingly whereas right now, the target supply seems arbitrary. Piecemeal district-level research in Lahore (authored by Tasneem Siddiqui) for example suggests that—based on a 2012 survey, 68 percent of the population (earning less than 30,000) from the bottom had access to 1 percent of the supply whereas 12 percent of high income (earning Rs250,000 and above) households had 56 percent of the supply. This means that supply is concentrated at the top.

This research needed to be done on a much larger scale to ascertain the demand-supply dynamics across urban and rural Pakistan. Without knowing these fundamentals, how can the government provide a target number of housing that needs to be built?

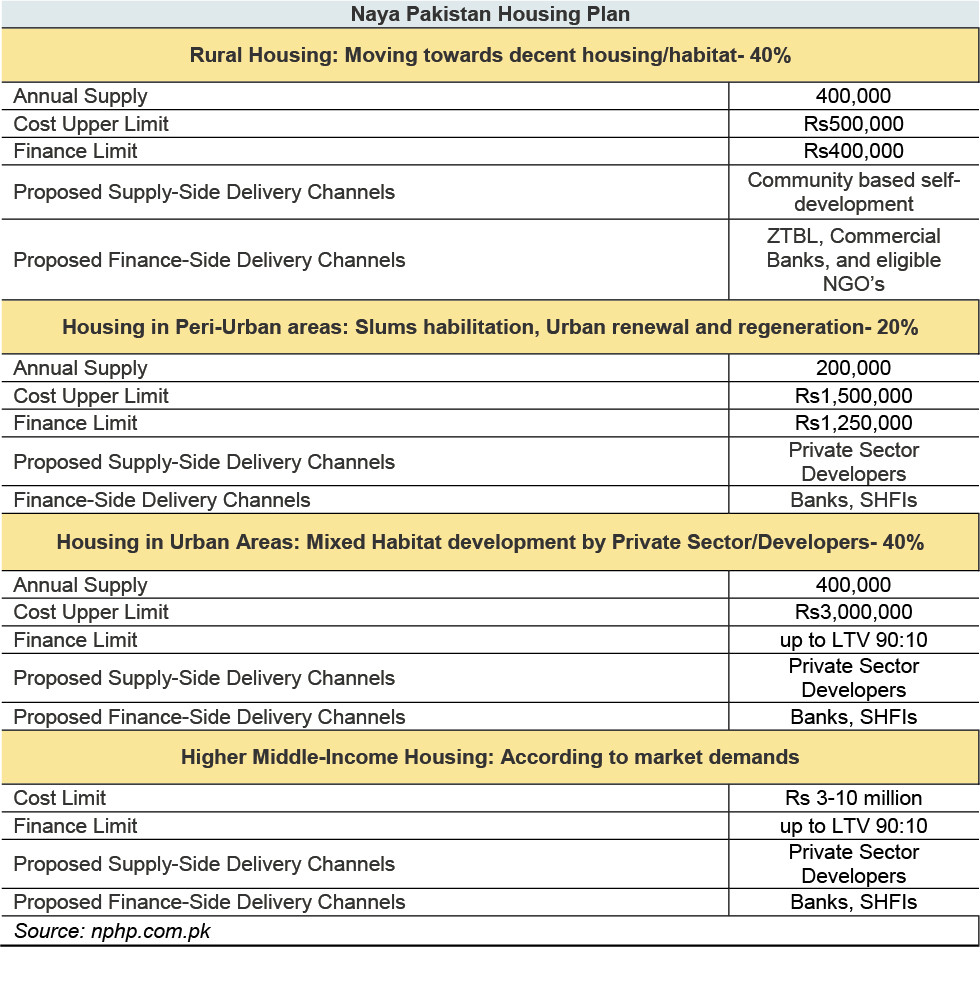

More importantly, it leads to more pressing questions: how will the government define affordability in order to target it via subsidies and other measures? In fact, who will utilize the announced of Rs30 billion subsidy? How much of the subsidy will be allocated for whom or which income groups? Though the official plan has provided the target price range (or rather upper limits) across rural, semi-urban, and urban locations, there are no income criteria to be eligible for NPHP. Or if it is, that is unknown.

On the official forms, there are three installment plans under the program. Applicants can pay a monthly Rs5,000 to Rs10,000 in the lowest category; Rs10,001 to Rs15,000 in the middle category and between Rs15,001 to Rs20,000 in the highest category. Let's do some quick calculations. If a house costs Rs3 million and monthly installment the consumer will pay is Rs20,000 (and also suppose this household was able to borrow from the House Building Finance Corporation (HBFC) under its “Ghar Pakistan" scheme that provides mortgages at 12 percent fixed rate for a tenor of 20 years), the subsidy the government will have to provide this house every month is about Rs10,000.

Now the government wants to build 400,000 houses in urban Pakistan in one year. The total annual subsidy for the above example comes to a whopping Rs47 billion! Does the government have this kind of fiscal space?

On the other hand, if one were to insist that this fiscal space could be created, can low income households afford even this? Using the global affordability metric, a household can afford the rent or mortgage payment of a house that is no more than 30 percent of their income. By that measure—though this is not contextualized to Pakistan's case which makes it unreliable in itself—a household will need to be earning Rs60,000 per month to afford an Rs3 million house under the NPHP given that the government provides this household the aforementioned subsidy.

Business cards

our sponsors